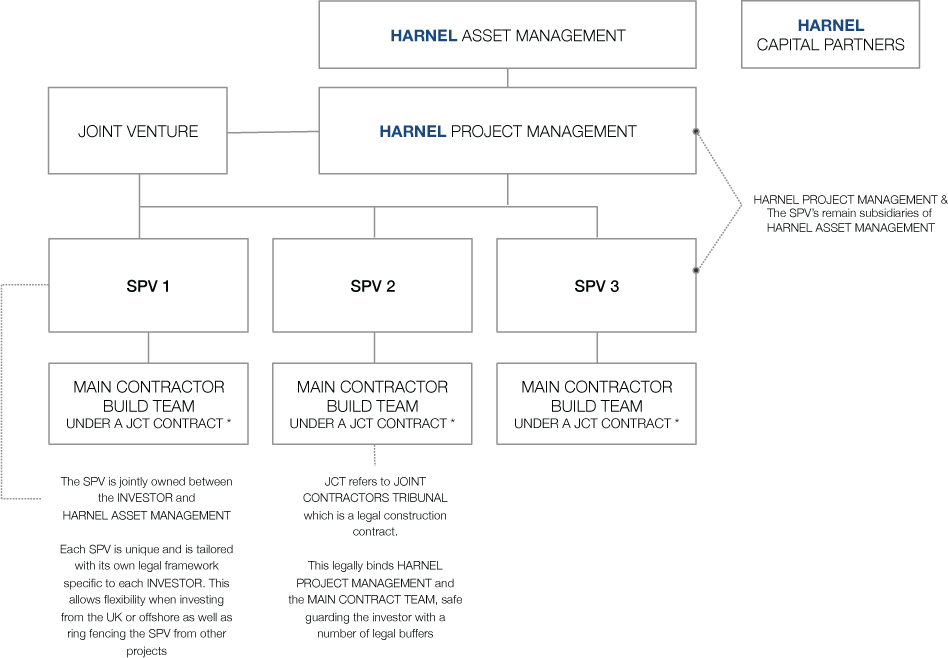

Investment structure

With longevity and stability at the forefront of our business, we seek to develop and maintain long-term relationships with our shareholders and investors.

This is reliant on a mutual understanding that the Harnel Group can sustain its shareholder’s objectives and deliver high standards across all of its companies and investment vehicles.

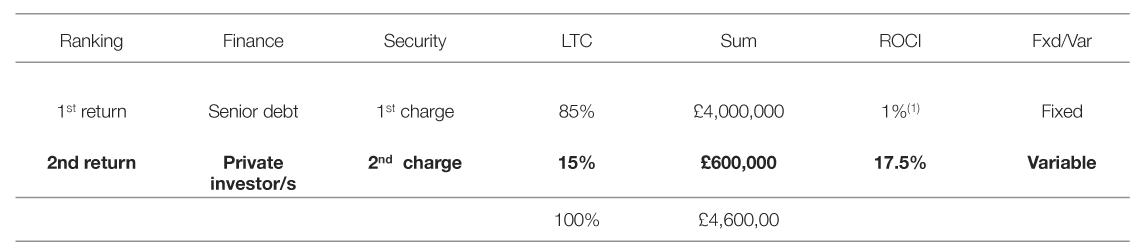

SPV finance structure

The table below shows a simple development funding structure using a traditional debt and equity system along with the associated returns on capital investment.

The senior debt is secured with a merchant bank or funding group at a fixed rate and 1st charge, while the remaining fund is available to a private investor or investor pool. In some cases, we structure the finance using a single high net worth individual and a blended hybrid of finance at a very attractive rate on capital investment.

LTC: Loan to cost

LTC: Loan to costROCI: Return on capital invested

(1) The senior debt secured at on a loan period, normally 12-24 months